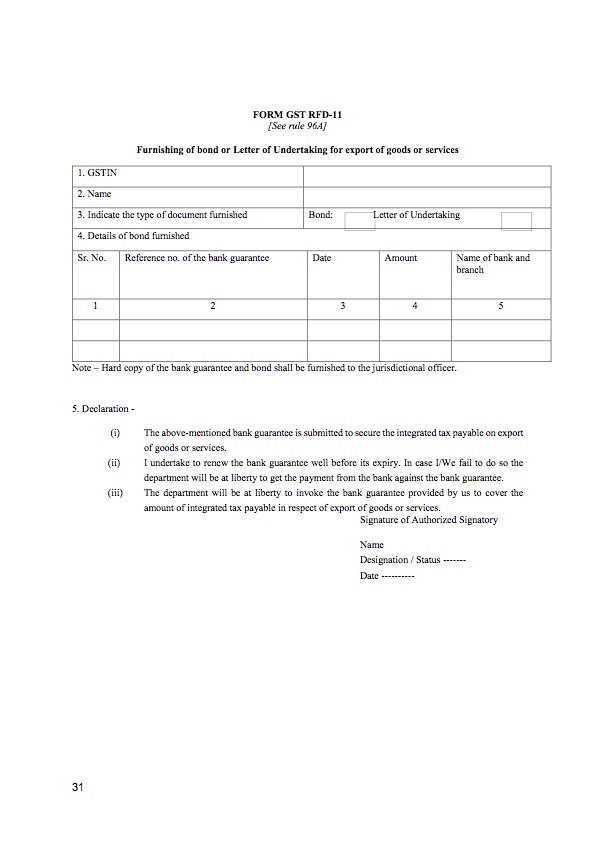

(GST) GST Form RFD 11

Central government in their notification dated July 1st, 2017, has introduced a new form GST RFD 11 in the context of 'Refund of integrated tax paid on export of goods or services under bond or Letter of Undertaking'

GST Form RFD-11 Context and Need

Here is the relevant section from the notification about GST Form RFD 11

Any registered person availing the option to supply goods or services for

export without payment of integrated tax shall furnish, prior to export, a bond or a Letter of Undertaking in FORM GST RFD-11 to the jurisdictional Commissioner, binding himself to pay the tax due along with the interest specified under sub-section (1) of section 50 within a period of —

-

fifteen days after the expiry of three months from the date of issue of the

invoice for export, if the goods are not exported out of India; or -

fifteen days after the expiry of one year, or such further period as may be

allowed by the Commissioner, from the date of issue of the invoice for export, if the payment of such services is not received by the exporter in convertible foreign

exchange.

GST Form RFD 11

GST Form RFD 11 download in pdf

You can download the gst form rfd 11 in pdf at /assets/humlog/gst/gst-form-rfd-11.pdf

Category: finance gst