PF Form 19

Form 19 is the form you need to submit for withdrawal of your EPF amount. EPF (Employee Provident Fund) is a corpus fund managed and operated by EPFO (Employee Provident Fund Organization). A part of your salary is deducted and added to your EPF account every month. In addition, the employer also contributes the same amount in your PF account.

EPF interest rate has been in the range of 8-10% in the past few years which means a consistently good return on your savings. Thus over the years, the total money accumulated in your PF account becomes a sizeable amount. If you want to withdraw this PF money, you need to fill up Form 19.

PF Form 19 - PF Withdrawal Form

To withdraw your PF money, either after quitting a job or at the time of retirement, you need to fill up Form 19 also known as PF Withdrawal Form.

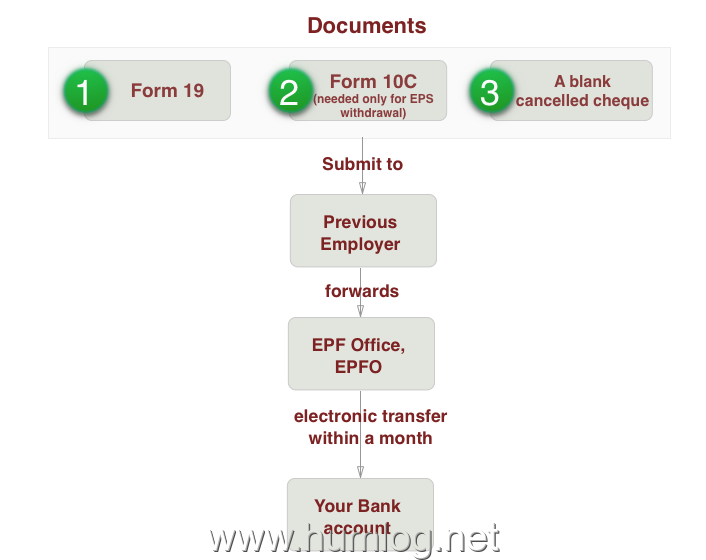

Form 19 allows you to withdraw the EPF amount only. If you want to withdraw the EPS (Employee Pension Scheme) amount also, then you need to fill Form 10C along with Form 19. Your EPS also called the pension fund is made up of a portion of the employer's monthly contribution (8.33% out of the employer's 12% goes into EPS).

Form 19 UAN - New UAN based Form 19

EPFO introduced a new UAN based form for PF withdrawal which is called 'Form-19 (UAN)'. The main benefit of this new form 19 is that you can submit it directly to the concerned PF office without going through the previous employer. Earlier it was mandatory to get your Form 19 attested and signed by your employer.

To be able to use this new UAN based Form 19, it is required that your

- UAN number is activated.

- Aadhaar Number is linked with UAN.

- Bank details linked with UAN.

- KYC documents verified by your employer.

If you fulfill the above conditions, you can use the new uan based Form 19, otherwise you can use the old, regular Form 19 without UAN for EPF withdrawal.

UAN Form 19 Download

Download Form 19 UAN on http://www.epfindia.com/site_docs/PDFs/Downloads_PDFs/UAN-Based_Form19.pdf.

Form-19 (UAN) is a very simple one page form and easy to fill. You just have to give your basic details like -

- Mobile number and UAN number.

- Name - It should match with your UAN records.

- Date of leaving & Reason for leaving - Select reason from the options provided. If you select 'permanent or total incapacity due to bodily or mental infirmity' as the reason, you need to submit a medical certificate. If you select 'migrating abroad', you need to submit a copy of the ticket, passport and visa.

- PAN number - If you have worked for less than five years, you need to provide your PAN number. This is for the purpose of TDS i.e. Tax will be deducted before crediting the money in your bank account.

- Form 15G / 15H - If your income is less than the exemption limit, then you need to submit two copies of Form 15G or Form 15H so that TDS is not cut on your EPF amount.

- Attach a cancelled cheque, which has your bank account number and IFSC code. This bank account number should be the one linked to your UAN.

PF Withdrawal Process - Existing Form 19

If your details like Aadhaar and bank account number are not yet linked to your UAN then no need to worry. You can still apply for PF withdrawal through the existing Form 19. You need to submit the filled up Form-19 to your previous employer along with other documents. The sign and seal of previous employer on Form 19 is compulsory to identify and verify the employee and his details correctly. The employer will then forward your withdrawal claim form to EPFO. If everything goes well, you will receive your PF money directly in your bank account (transferred electronically) within a month of filing the withdrawal claim.

Download Form 19 on http://www.epfindia.com/site_docs/PDFs/Downloads_PDFs/Form19.pdf. To see a filled sample of Form 19 and the PF withdrawal process read PF Settlement Process - Form 19.

Be careful in filling up the fields in Form 19 to avoid any rejections of claim.

On the second page of Form 19 you need to affix a Re 1/- Revenue stamp and sign across it. In Bangalore, affixing a revenue stamp is not required so companies in Bangalore accept the PF forms without it.