EPF Composite Claim Form (CCF form) Aadhaar and Non-Aadhaar for Withdrawal claim

EPFO (Employee Provident Fund Organization) has been working on simplifying the process of withdrawal from EPF (Employee Provident Fund) and EPS (Employee Pension Scheme). Earlier it has issued a new version of Form 19 & Form 10C for withdrawal and new version of Form 31 for Advance from member EPF account. But this process is now simplified even further with the introduction of new single page CCF forms.

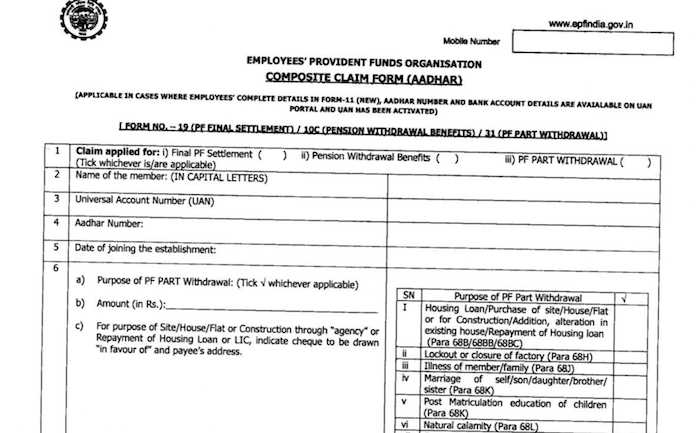

CCF full form is Composite Claim Form and it is new simplified single page form for PF fund withdrawal or advance from EPF account. CCF Form comes under active circulation from Feb 20, 2017.

CCF form comes in 2 variants depending on whether you have linked you Aadhaar number with EPF account or not.

These new CCF form replaces earlier form 19, Form 19 UAN, Form 10C, Form 10C UAN, Form 31 and Form 31 UAN.

Another important point of CCF form is that members can use self certification for advance (partial withdrawal) and don't need to submit supporting documents. Earlier for example, for advance in case of marriage, one had to submit marriage card - this is no longer required. Similarly one need to only submit self declaration form for house construction or alteration in existing house.

EPF Composite Claim Form Aadhaar (CCF Aadhaar)

CCF Aadhaar form (Composite Claim Form Aadhaar) is for those EPF members who have linked their Aadhaar number and bank account details with their EPF account.

CCF Aadhaar form does not require any attestation from employers and thus is the simplest way to withdraw or take advance (partial withdraw) from your epf account.

EPF Composite Claim Form Non Aadhaar (CCF Non Aadhaar)

CCF Non Aadhaar form (Composite Claim Form Non Aadhaar) is for those EPF members who have not linked their Aadhaar number with their EPF account.

These members can use CCF Non aadhaar form now and need to get their form attested by their employer before submitting it to EPFO.

We strongly recommend EPF members to get their Aadhaar and bank account details linked with their epf account as this will remove un-necessary hurdles faced by members. Once you have linked your Aadhaar number, you don't have to rely on your employer to get you hard earned money. It is especially important for people working in small companies because sometimes company closes and it becomes impossible to get employer attestation for epf withdrawal later.

Category: finance epf