PF withdrawal process - Form 19 (EPF) & Form 10C (EPS)

When I applied for withdrawal of PF/EPF from my last company, it took me some time to understand the process. To make it easy for you, here are the step-by-step instructions for PF withdrawal.

Documents required to submit to your last employer for EPF withdrawal

-

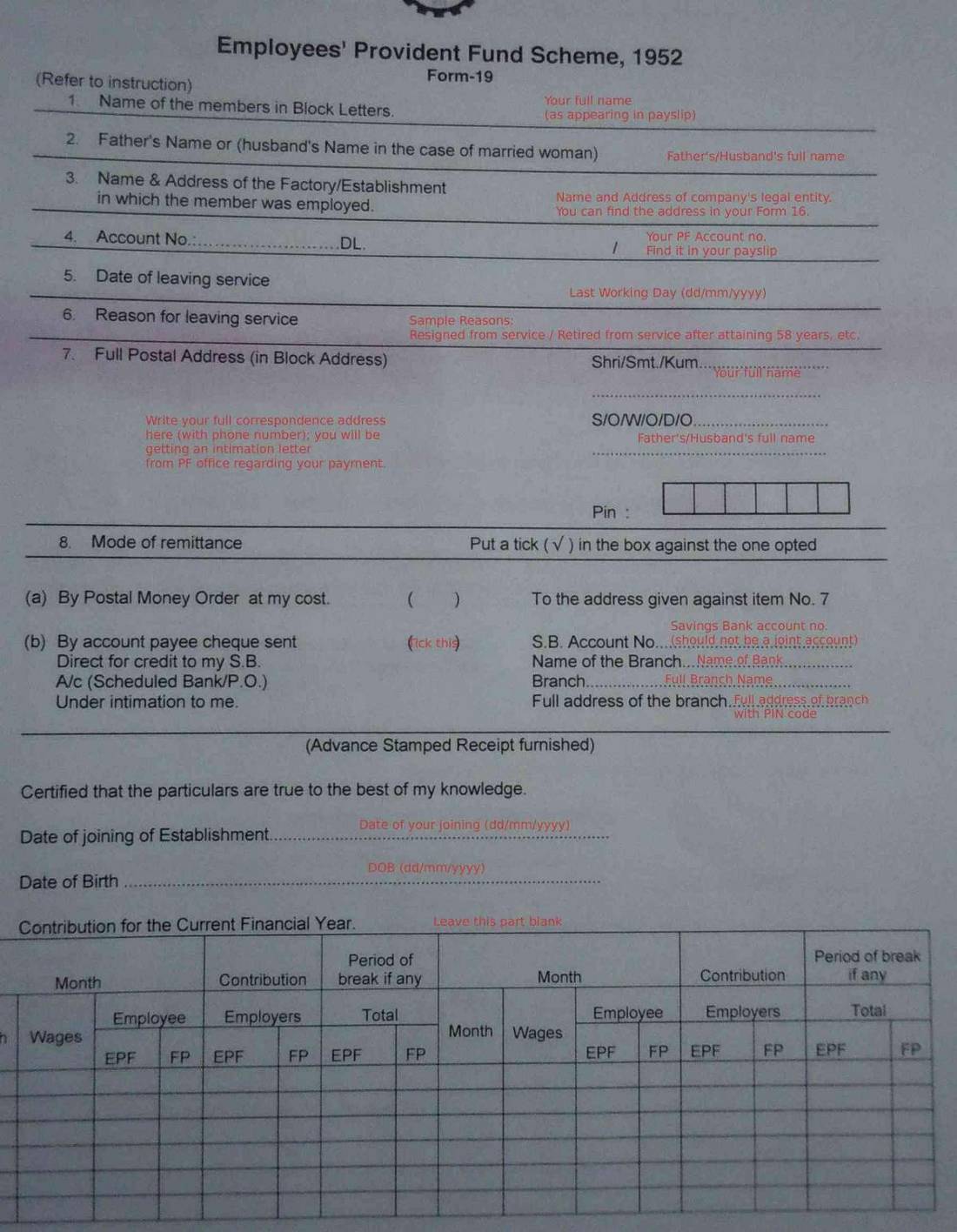

Form 19 (for EPF withdrawal)

-

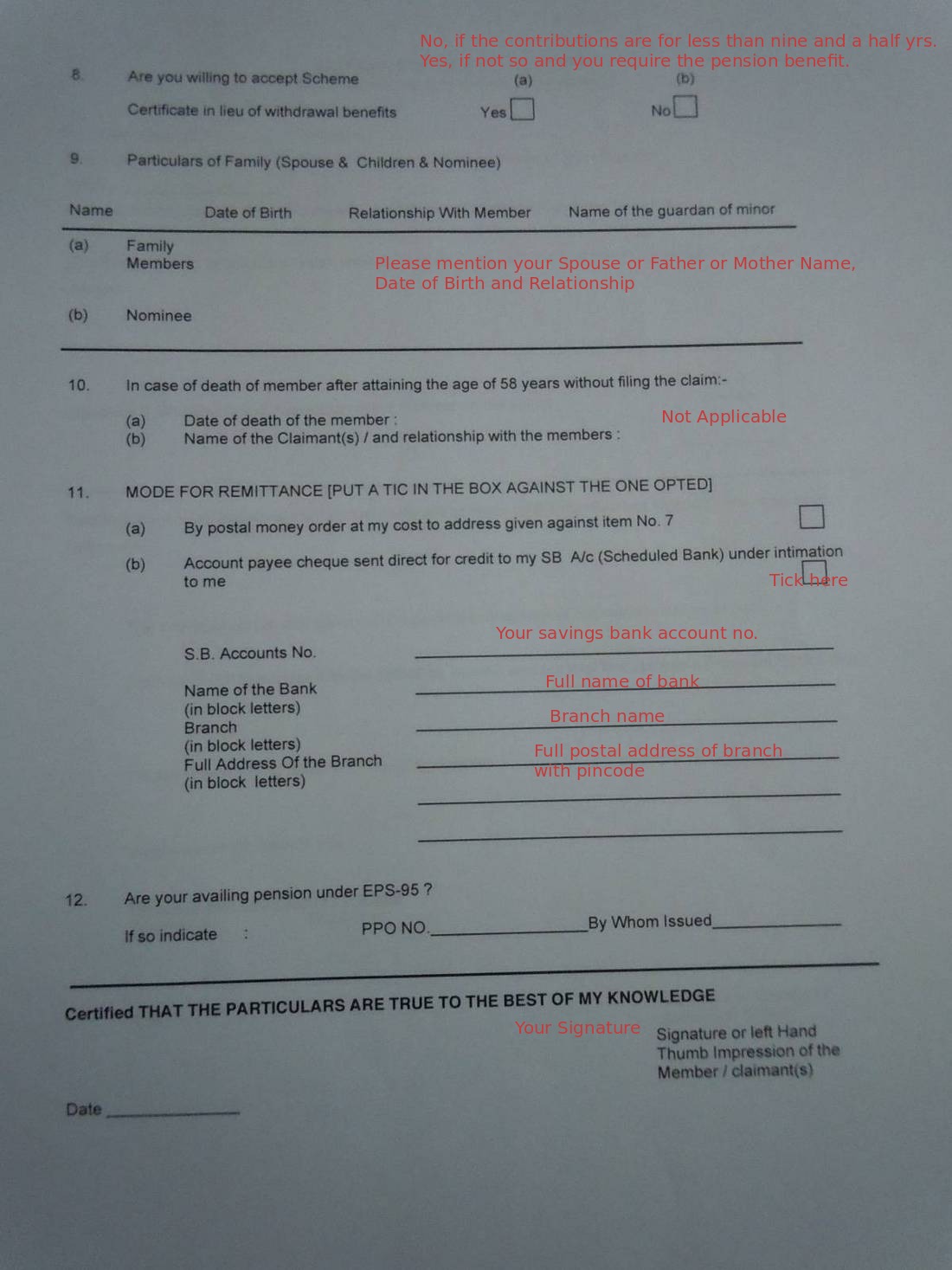

Form 10c (for EPS withdrawal)

-

A blank cancelled cheque (this is required to ensure that account number and IFS Code are clearly visibly). The cheque should be of you as a single account holder and not a joint account cheque.

Update 1: In July 2012, EPFO has declared that it will accept joint bank account only if the bank account is maintained with the spouse. Link to EPFO Circular

Update 2: In December 2015, EPFO has issued new UAN based withdrawal claim form 'Form-19 (UAN)'

Instructions on how to fill Form 19

I have put instructions in red against all the rows that need to be filled. Right click and open the below images in a new tab and then click for zoom.

Form 19 Page 1

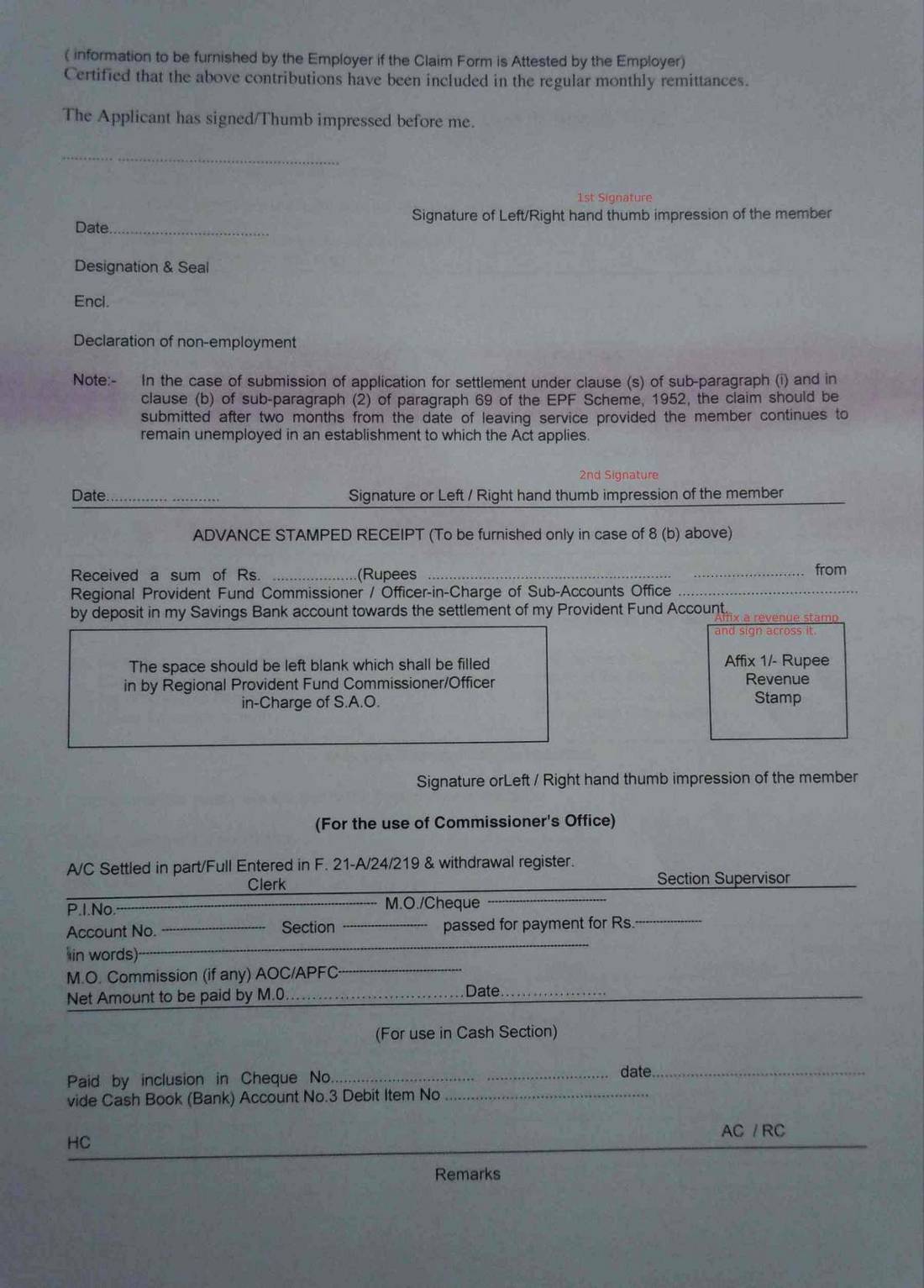

Form 19 Page 2

Please ensure to fill all the required fields in Form 19 correctly to avoid any rejection of claim. Below is a checklist of important entries -

-

Mobile Number - Fill in your mobile number at the top of the Form 19.

-

Name - Ensure that the name you fill in is exactly same as in your pay slips. Most claims get rejected because the name filled in the Form 19 differs from that in EPFO records. The name S. L. Goenka is different from Shyam Lal Goenka.

-

PF Account Number and UAN Number - Be very careful in filling out the PF number in right format. Any mistake and your claim will be rejected.

-

Address - This is the address where you will receive any communication from EPFO.

Instructions on how to fill Form 10c

I have put instructions in red against all the rows that need to be filled. Right click and open the below images in a new tab and then click for zoom.

Form 10c Page 1

Form 10c Page 2

On page 3, you will have to affix a Revenue stamp and sign across it. Thats it. You need not fill any other details.

Download EPF withdrawal /PF withdrawal forms

Revenue Stamp availability in Bangalore

Post offices do not keep revenue stamps. I was able to get it from Koramangala BDA Complex for 5/- Rs. per 1 Re. stamp.

In Bangalore, affixing a revenue stamp is not required so companies in Bangalore accept the PF forms without it.

Know your claim status

Once your application is forwarded to the epf office by your employer, you can check your claim status on epfo website. You will also receive a sms from epfo stating that your application is received and is under process.

With all this information at your hand, I hope you would enjoy the process of submitting PF forms :)

Update: My PF money is transferred to my account electronically within a month of filing the claims.

To read all articles related to EPF/PF go to EPF/PF - All Articles

Category: finance

Since Jan 10 to Jan 11 (IBM Global)

Since Feb 11 to Sep 13 (Concentrix)

I have transferred my IBM's PF account to Concentric PF account on Nov 2012. Now I want to withdrawl my PF as I've completed 5 yrs.

Shall I need to submit documents to my first employer (IBM) or previous one (Concentric)?

My firm is shut down so pls help where taken the signature of Bank manager in form 19 & 10C

karthikeyan s

As i relived in my previous company now it almost 2.3 years shull i apply for pf withdraw because one of my previous company HR he said that you have to apply withdraw along with affidavit what i have to do kindly suggest me sir.

Regards

Prakash

I am Kumar, i need an clarification about 1rs revenue stamp is mandatory to affix on PF withdrawal form. because it's not available in Bangalore.

So please guide me what action to be taken, & if possible can i know where i can get REVENUE STAMP in Bangalore.

Thanks & Regards,

Kumar B.V

I have resigned from my previous organization and joined Govt. Organization which was with immediate effect... I failed to attend the notice period but company needs me badly... so they havent accepted my resignation and ask to rejoin me and train new person.. at least for 3 month... I am ready to pay compensation amount... but they refused to take...

Now, I want my PF back... Can I get It ??

and i wanted to know if we need to submit the forms and cancelled cheques to company only or can we submit it to PF office directly

thank u

approved and verified the forms and sent it back to me.

So, should i consider it as that i should send it to EPF office.

if yes, then should any other form be submitted with this?

and at what address should i send this?

My EPF office is at New Delhi, North.

Kindly Help

I Have left my company since one year before also i have submit my withdraw form but no response from my organization so kindly tell me can take my money in any epf office in india.

Form 19 and 10c need to submit by employer or we can submit ourself.it is been 6 months have left organisation...can we submit for withdrawal now..please guide me..

My PF office mentioned as Bangalore but I am not in bangalore now..so I need to post those two forms to PF office address...

Could you please guide me..

Thanks you.....

I have submitted my pf forms and documents on 15th Nov,14 but yet I havent received my amount or neither I had got any revert.

Can you please tell me or suggest any number so that I can contact?

I have submitted the form 10C and 19. But pf office rejected the form due to employer didn't pay the remittance. But employer show the remittance payed statement. Epf officer say once again submit the form 10C and 19. I'm also submit but till now I couldn't get any message from epfo. Anyone tell me a better solutions.

Pf number: TNAMB00698640000000027

Need help..!! My previous employer in Chennai told me that they wont submit the PF form, they did all the formalities and given to me. And due to lack of time I came back to Bangalore. Can I submit that form in Bangalore PF office? Please answer me.

Thanks in Advance

thanks for your help

thank you

I have check the pf withdrawal form status. It shows as in process....so can u tell me how much time normally its taking to deposit pf to account.

i wanted to withdraw pf now from the company i was working before joining the previous org. but the problem is i was working in tht org during 2004-2006 (part time - call center). i left that org without getting a releaving letter .

is there any way i can withdraw on my own/without submitting any docs in the company. like directly going to EPF office ?

Kindly suggest.

You can get it attested by your bank manager also. Please read "What to do if I don't have good terms with the previous employer" in my previous post - <a href="http://www.humlog.net/finance/faqs-epf-withdrawal">Frequently Asked Questions on EPF Withdrawal</a>

Have you get any sms from EPFO yet? They will send a sms when they receive the forms. If you have not received, then contact the employers and ask them whether they have sent the forms.

I don't know of any other alternative.

My EPF Claim status showing "No Record Found". What should i do? I have submitted my EPF 10 C & 19 form to the my organisation. But still i could not receive my EPF amount. I want to know that my PF form successfully submitted to the PF Office or not.

Can you help for this? Please reply the same.

Plz can someone confirm...

my mail id- rphil2010@yahoo.com

I would like to know whether processing time does form 5 & form 10 required along with form 19 & 10c while submit the pf form to Pf office

My PF Settle amount PF office sent to wrong account , i have mentioned my correct account no. on form & attached Cancel cheque also but pf office while sent pf amount through NEFT then mistkely type one digit wrong .

now please guide me what can i do.

I have checked with my bank then they assure me they are checking account name & no. in NEFT transfer case & in this case they told me pf amount might be returned.

and i have asked them about wrong account no. then they told me such account no. is not exist ( pf sent my pf amount which wrong one)

Thanks

mahadev

Can you please let me know how much time it will take for money to be credited in my account after receiving below message.

Status : Claim Form 19 for PF Settlement AGAINST Member Account No () has been approved. Payment is under process

I have resigned in my previous company on 8th Sept'14. Now I want to withdraw my PF amount via Form 19 & 10 C. I don't have any Single name account in Punjab National Bank , but I have a JOINT Account ( First name is mine & second name is my Wife's name--either or survivor facility ). Will this JOINT ACCOUNT be considered by the EPF Authorities as correct and will they grant it ? Can I submit both -a photo copy of my PASS BOOK's first cover page as well as one cancelled cheque ? If only one is required then which is better option ? Please HELP !

Could you please share some information about Withdrawal of PF amount online.

BTW, this article clarified most of my doubts about filling out the withdrawal forms. Thanks a ton.

I look forward to your response.

Thank you.

I want to know about is there any chance to withdraw the amount with in 1-2 weeks like paying any challan amount for to get soon the amount. if there is the chance Please let me know.

It was very helpful.

Hi,

Can i use another account number (any nationalized bank account) to withdraw my amount? what if i dont have a cheque right now, can i use passbook photocopy? plz help.

Thanks and Regards

Syed Mamoon Ahmad

In july our company is merged in other comapny where new company given us opprotunity to work with them.

we have released letter from our compnay on dated 07 july 14.

SO i have some doubts so please help me & suggest .

1) So now i want to withdraw PF amount so what date i will put in last date of resigned/leaving from company (my boss is saying put Dec 12 & but actual leaving date is 07 july 14)

2) Please suggest any legal way to get my salary amount back from boss (suggest the way where i can complaint )

3) in pf 19 form there is table "Contribution for current financial year" can i write here or should i leave the same

Please suggest me.

Thanks

mahadev

I don't have clear answers for your questions. Please consult some expert, a CA may be. Also please share your experiences on PF withdrawal, once you get your amount. It would be useful for other readers. Thanks

Status : Claim Form 19 for PF Settlement AGAINST Member Account No () has been approved. Payment is under process.

Status : Claim Form 10C for Withdrawal Benefit AGAINST Member Account No () has been approved. Payment is under process.

Myself Mahadev Panchal

i had resigned from my company dated 07 july 2014, but my company is submitted my pF amount in pf office which is cut by company dated sep-12.

after Sep-12 they have not submitted My PF amount into pf office due to some funds issue.

so in this period they even not given any salary also .

that's why i resigned from the this company on 07 july 2014.

in this case if now i want to withdraw pf amount so please tell me the process & what i need to do in this such case.

Thanks,

Mahadev

Are you able to check your balance online? Since it is only around 2 years that there are no contributions made to your account, it should be still operable. Please check the balance online and then withdraw as stated in the post. Same procedure.

Yes i am able to see my pf balance online. but i want to file complant against this company & for 2 years my salary want to recover from this company.

so for that can you please guide me how i can go further

thanks

mahadev

regarding UAN number update.

they are send aUTO SMS to GET UAN number from employer.

I have searched in EPF Site where its shwon UAN number is not alloted to my Company.

so please suggest ??

Sorry i am asking you so many questions but what can i do m in trouble so please bear me .

I am very thankful if you give reply

thanks

mahadev

I have given a joint account cheque (account is joint with my spouse for PF withdrawal). The HR person says it should be of a single account but as per the Circular No. WSU/17(2)/2000 dated 15th June 2012, a joint account cheque is allowed provided the account is with the employees spouse. Please confirm if this is correct.

I got a couple of questions. Does one need to fill for gratuity separately or does this amount come automatically with the PF? Also, does the employer contribution and employee contribution come together and gets credited into your account one time?

My company HR has told me to submit the documents (present with me) after two months?

HR has submitted from the Employer side.

How to check if i can submit them early?

Thanks,

Abhijit

I want to know that I can attach attested copy of my bank pass book which is showing my account detail instead of a canceled cheque.

1st doubt - does this one year gap will have any impact on withdrawing my PF

2nd doubt - As per rule a person can withdraw PF only if he/she is unemployed

Please help me in this to resolve the above said issue,

Thanks in Advance

2) Yes, legally you should not withdraw if you are employed. You are supposed to transfer the old account to the new one.

Thank you for ur information, one more doubt, now for PF process GOVT had created a UAN, and some of them told me that it is not possible to withdraw the PF amount here after, because UAN no is been created for all the individual so they will keep track of your PF records, so we can only transfer the amount, can't withdraw the PF amount, is it so., if it is yes, please tell me some ideas to withdraw it, since i need that amount for my mother's operation. please help me

my pf form 19 had been rejected i want to know to which address it get dispatch to my residential address or company address and in how many days , if company address the my company had been shut down so where it will go return to pf office. is there any other way to claim again.

waiting for reply.

thank and regards

sakte hai

I just wan to know , when we leave job with exp of 2 years and 10 months and i chose to withdraw the EPF and EPS .... Can i withdraw both because my company told me that if you withdraw it , u will get only EPF but will loose EPS!!!!

is it so ?

And how much my EPF amount should be?

I worked in Polaris Software Labs: Mumbai

2 years and 10 mons

my basic pay is 7012

But they didnt send me any claim rejection reason as well !!!!!!

My service was of 2 years and 10 months , is it like if we do not transfer the amount to next organisation, we loose EPS part?

Thanks for the information... it is a great help...

I HAVE A JOINT ACCOUNT WITH MY WIFE SO I CANT USE THAT ACCOUNT?

Claim ID : TNMAS140500016104

Status : Claim Form 10C for Withdrawal Benefit AGAINST Member Account No (TNMAS00854610000002610) has been approved. Payment is under process.

But still i didn't get amount.. can u have a look. please help me

you have gathered good chunk of appropriate info for filing EPf forms.i was little confused whether should i apply for only Form 19 and after reading your blog I actually got a clear picture of filing form 10c too.

Thank you mate..

Gud day

I have a confusion whether I can withdraw my PF or not. Actually I have resigned my company in one emergency situation and did not get the relieving from my last company in Bangalore. Can I apply for the PF as its 2 months now when I left the company. Is there any letter or approval required from the company to withdraw the PF? Please advise..

Appreciate your quick response.

Thanks.

I hve submitted form 19 and 10c for pf withdrawal. I received sms stating its approved for payment through cheque... but I had clearly opted for ECS mode while filling and also furnished the relevant info including cancelled cheque.. can you please tell me how long it might take and if I will be receiving the cheque or will it still be sent to bank for direct credit ? ??

- thank you !

Hats Off to you!!!!

I want to suggest you Plz upload every from with guidance how to fill that.

Thanx to you

Can you tell me when should i receive amt as epfo site says application received on 27/05/2014.

Employee PF Account Number* :

STATUS for Member ID: TNMAS00357910000310850

Claim ID : TNMAS140500059185

Status : CLAIM FORM 19 FOR PF SETTLEMENT FOR MEMBER ACCOUNT NO TNMAS00357910000310850 HAS BEEN RECEIVED ON 27.05.2014 IS UNDER PROCESS

Claim ID : TNMAS140500059188

Status : CLAIM FORM 10C FOR WITHDRAWAL BENEFIT/SCHEME CERTIFICATE FOR MEMBER ACCOUNT NO TNMAS00357910000310850 HAS BEEN RECEIVED ON 27.05.2014 IS UNDER PROCESS.

* * Data available since last six months. * *

* * CHENNAI data availaible from 09-01-2014. Last updated on 09-07-2014 at 08:00 am * *

Thanks,

Veerabhadra.

my self Tarun i have submitted my froms 19 and 10c

to my employer in july 2013 after submission of my claim I checked my claim status on epf site but it shows no record found data available since last 6 months

what i need to do to know my claim status?

Thanks

Really Appreciate for your information on EPF, which makes thing very easier in getting the PF amount.

I have a query, please help in resolving the below,

I had worked for 18 months, so my Pension Fund is 9738, but after submission of form 10C, I got the amount 9737.

-> Please suggest how much money should I get

-> Also suggest whom should I contact to get my actual amount, if the amount which I got is incorrect.

Thanks & Regards,

Praveen Jain

1) How do you come to know that your pension amount is 9738?

2) Is it only 1 Re difference that you are talking of?

3) In order that I can calculate your pension amount, I need to know your basic pay.

->With the help of E-passbook i came to know my pension amount is 9738

->Yes only Re 1 difference, but I have worked for 18 months so i guess my pension amount should be (9738*1.99=19378) but I have got only 9737

->My basic pay was 8400

Please help with my confusion, also suggest whom to I contact to get my correct amount.

Thanks & Regards,

Praveen Jain

As far as I know, If you have worked for even a day less than 18 months ..it would be counted as 1 year after rounding off...

If you still think that you have got a wrong amount, you can contact the regional EPFO

I have applied to pf 1 month ago, I got my EPF amount to my account but still I didnt get the EPS amount, 1st the form 10C was approved then after 1 week the form 19 was approved, but I have reserved the EPF(form 19) amount 1st and there is no update on EPS(form 10C) please suggest what the reason EPS is delayed. waiting for ur replay.

Thanks,

Praveen

I was working with a company for 1.5 years. Due to some health issue i had to abscond from the company. My status is absconded with the company. Can i withdraw my PF money.

Please help me with the information.

my father deposited form 19 for pf withdraw,And we are receiving a text form pf office that our claim in the processing, but we are never understand how to claim form 10 c (ESP). And also we are don't know that 10 c deposited or not, all the necessary step done by my father office staff. so is it possible that 10 c is deposited by time of pf form deposited ? And we are also want to know that how much taken time for receiving money after claim id under process.

If you help me for regarding this matter i really thanks full to you..

Surajit mondal

ph: 9681216640

e_mail : surajitmondal02@gmail.com

pls sugges me how can receved my pf amount . Because i was leaved my previous job .

I appreciate your kind gesture

STATUS for Member ID: TNMAS00357910000302934

Claim ID : TNMAS140500058891

Status : CLAIM FORM 19 FOR PF SETTLEMENT FOR MEMBER ACCOUNT NO TNMAS00357910000302934 HAS BEEN RECEIVED ON 27.05.2014 IS UNDER PROCESS

Claim ID : TNMAS140500058898

Status : CLAIM FORM 10C FOR WITHDRAWAL BENEFIT/SCHEME CERTIFICATE FOR MEMBER ACCOUNT NO TNMAS00357910000302934 HAS BEEN RECEIVED ON 27.05.2014 IS UNDER PROCESS.

* * Data available since last six months. * *

* * CHENNAI data availaible from 04-12-2013. Last updated on 02-06-2014 at 08:41 am * *

* * Approval Details on PPO and Scheme Certificates will be made available soon.. * *

Kindly let me know when will I recieve the money??

I liked this blog and I hope it can help me like it did for so many people.

Previous employer is asking for Id proof, address proof, PAN card along with the crossed cheque as additional documents for filing form-19/10C.

I didn't find any reference to additional documents other than crossed cheque. Can you please let me know if the rules have changed at EPF office or it's just my ex-employer is asking for it for it's own use. Again if these documents are required, please share any info on which documents could be used for Id/Address proof.

Please let me know are revenue stamps required. I stay in Bangalore and withdrawing from Accenture Services Pvt. Ltd.

I have a question here, where did you submit this form? To your last employer or some PF office?

the sad thing is that these guys do not inform us if the claim been rejected. so that we can be aware of the reason and do it again without waiting for a long duration

Thanks a ton...

My wife has left her job and is unemployed now. I am told by her previous employer that a notary certificate saying she is unemployed is needed for wiothdrawal. Can anyone help me to know if this is mandatory and where is this mentioned? Thankyou.

I have got a message saying payment under process through cheque.

Actually, i have opted for NEFT and enclosed a cancelled cheque also.

When they say payment through cheque, do they send a physical cheque to the addree or its elctronic transfer?

Thanks in advance..

Thanks in advance

I am on notice period and soon will be in need of the information regarding PF withdrawal. However i have heard as per latest rules for PF, we can only withdraw it after we show our Unemployment for 3 months, so is this true??

Dear sir

pls check my id & reply

Member ID :TNMAS00486170000005231

I have heard that if you are working somewhere then you cannot able to withdraw the PF of your last organisation. You only can withdraw in such condition if you are not working anywhere. For the same they want the affidavit (on Stamp Paper) on which you need to mention as you are not working anywhere.

Please let me know that as currently If I’m going to apply for PF withdrawal so do I need to submit an affidavit with the documents or not?. Currently I’m working with another organisation and want to withdraw the PF of last organisation which I left 1.5 Year back.

Also if it is not required then what should I need to do as the last organisation is asking for the same.

Regards,

Roshan

You should not withdraw your EPF if you are currently working. Just apply for transfer of that old EPF account to your current employer.

No idea why they got rejected. You can contact your regional EPFO regarding this.

I have submitted all documents on 21st march but its not showing in the claim status . Any specific reasons .for that . My account no is DL-0017900-000-18919. Kindly reply

what is that mean.. shall i receive my pf by cheque?

Claim ID : BGBNG131200024641

Status : Claim Form 10C for Withdrawal Benefit AGAINST Member Account No (BGBNG00251380000018249) has been rejected. Rejection letter is under dispatch/ dispatched to address in your claim form.

Reason of Rejection: The reason of rejection is not available in database. You may please contact RO/SRO BANGLORE for further details.

Claim ID : BGBNG131200024641

Status : Claim Form 19 for PF Settlement AGAINST Member Account No (BGBNG00251380000018249) has been rejected. Rejection letter is under dispatch/ dispatched to address in your claim form.

My confusion is that my current employer doesnot have any facility of PF, so the salary i receive does not have the PF bucket... and my previous employer had PF account assigned to my salary the regular way. Where should i submit PF withdrawal in such a case?

You should submit the withdrawal forms to the previous employer.

I have applied my PF and now PF status showing that we have received your frm 10 and 19 on 18th of this month but still i didn't my PF money.just i wana know still how much time get my PF money to account...

thanks in Advance..

Regards,

Srinivas.

Your help will be much appreciated

Thanks,

Ann

I have changed my job and need to withdraw pf from my previous company.I have filled for 10c and form 19.My doubt is do i fill the nominee field in form 10c (point no 9).

Also the bank account no which we mention in both the forms should they be the savings account where my previous company deposited my salary or any other account would do?

Regards,

Rahel.

First of all thanks for article regarding PF withdrawal.

I submitted my PF withdrawal form in my last company but they merely signed and sent it back to me. When i enquired then they told me that i need to submit the form in PF office myself. Do you have any idea how to submit PF withdrawal form by post. I am currently working in Hyderabad and my PF account is with bangalore PF office.

Regards,

Shekhar

You can send the forms and other documents (as described in the post) by post to the bangalore PF office. Once they accept your forms, you should get the money in few days.

WILL THESE ALL DOCUMENT HELP ME TO CLAIM MY PF

your blog helped me in crucial time

Regards

I have submitted the forms to the previous employer, but they are delaying it to submit the same to EPF office. Can I collect the signed form from previous employer and submit directly to the EPF office? Is there any specific procedure for that?

Thanks in advance,

Rajesh

When i check the claim status in the epf website, 4 rows of details are displayed. How will i know which one is the latest

Also where in Koramanagala BDA complex can one buy stamps. Is there any government office or any

agent who sells the stamps? any pointers would be of great help

The information provided by you is very useful. Thank you for that.

My previous company has been closed. Will you please tell me

1. What is the procedure for pf withdrawal. is there any difference than the regular procedure which you have described?

2. Who can be authorized signatories on Form 19 and Form 10C?

How to go for the PF withdrawal if our company has changes pf accounts many times around 3-4 times.I have to go separately for each pf accoutn??

Please help.

i have following queries

1)If i serves more than 10 years than how can i get my EPS money back...? ,is not it a loss of my money ? if not than please let me know how?

2)money in EPS deducted for 10 years only or the time you serves (if more than 10 years...)

2. money is deducted till the time you serve.

Why for PF withdrawal I necessarily required separate a/c

Please suggest me.

1. Can I personally submit the 19 & 10C Forms to EPF Office?

2. Can I submit it without previous employee's seal/stamp & signature?

3. I am from KOLKATA. But as per my PF account is maintained in Chennai (as per region code in payslip). If want to submit personally, which office I should go ? Kolkata or Chennai

2. Technically yes. Employer's signature/stamp is required on the forms. If however, you are unable to get it, you can get it notorised in the place where employer has to sign, submit to pf office with your covering letter indicating the reason why you can't get previous employers' signature.

3. Chennai

May I know the process of online PFW submission directly to PF office?

May i know to whom it has to be sent and address?

Thanks

This ganehbabu from chennai.

I was working with PCS TECHNOlOGY for approx 3.10 years.Then I had to quit my Job in July 2013. Now I went to submit the PF withdraw But they are Said like must require Aadhaar Number then only to submit PF.

Currently I don't have aadhaar number . Please tell suggest me....

Thanks,

Ganeshbabu.T

The pf office have rejected my pf forms stating they need the 5A form from employer!!! The employer says this is not required. They have also lost my pf forms. A part of my pf is in Bangalore. The company was taken over in between and so the remaining part is with Maharashtra PF office. I am now left clueless as to what to do as I do not know how to check the Maharashtra PF status and about Bangalore where to get 5A form. I am just being juggles between my employer and PF office. Can you please guide me as to what to do?

You can transfer the amount from the old PF to new one by submitting Form 13

Thanks for wonderful post, I have a query.

1. I was working with my previous Employer, and it's been 3 years I haven't withdrew my PF. Do I need to file an Affidavit

2. I was transferred from One branch to another, and hence have a different PF Account number, problem is my Org has my Original DOJ, and not the one on which I was transferred to Hyderabad Location. Do we need to have exact DOJ on Forms?

Regards

Amit

1. Yes, I think an affadavit is required. Please read more on this <a href="http://www.citehr.com/151764-indemnity-bond-affidavit-pf-withdrawal.html">here</a>

2. Yes, I think you need to put an exact DOJ. You can confirm this from your employer.

While submitting the PF form to the PF Office, If mobile No. is not mentioned how will I get the information that my application is under process. Should I again approach the office for giving mobile No. Please advice.

Thanks in advance and hope to receive your advice soon.

Please find my query below:

I have submitted forms 19 and 10-c in my previous organization by filling the salary account bank branch details.

But now I had to close that account due to financial constraints. So, what should I do to get the amount?

It would be grateful if anyone can answer my concern.

I suggest you try contacting your regional PF office at the earliest. The contact numbers are given in <a href="http://www.epfindia.com/epfo_directory.html">EPFO directory</a>.

Today i have received 2 sms stating forms are approved and payment under process, Could you please tell me how long would it take from here? i am in sort of urgency for money. thanks

U got another sms from pf or jst from bank.

Re posting my query.

After going through many of your comments, I feel like submitting the EPF withdrawal form in a new financial year will not cost you any tax, provided that your EPF comes under 190000 or so(the minimum slab & the person is not in india or no income).

Withdrawing PF(for person leave India) in a new financial year does make any difference from tax deduction point of view?.

Thank You,

Mohamed

1) Do we need to submit both forms on all cases? I have served for more than 7 years?

2) Does the cheque leaf needs to be signed & cancelled?

2) Sign is not necessary. Just cancel it.

I really appreciate your effort in making the process simpler with the pictures. I followed the same way you have mentioned above. But I have few questions heard in middle of this process.

1. The EPF+ EPS is taxable if the person served less than 5 years (In my case 4.8 years)

2. Do I need to submit something like form16 for tax exemption on the amount the PF dept. is going to deposit?.

3. Are we going to get any receipt after submitting the forms for withdrawal?.

Waiting for your update!.

Thank You

2. There is no provision for tax exemption on EPF withdrawal if service is less than 5 years, so submitting any form for same is pointless. Furthermore, Form 16 is a document that is issued to salaried personnel in India by their respective employers. It furnishes various details such as Salary Income components of the Employee, Tax Deducted at Source (TDS) by the Employer, and Tax paid by the Employer to the Income Tax Department.

3. You will get a sms from the EPFO office that your forms are received and are under process. Till then, you have to keep the speed post receipts as a proof of sending the forms to EPFO.

After going through many of your comments, I feel like submitting the EPF withdrawal form in a new financial year will not cost you any tax, provided that your EPF comes under 190000 or so(the minimum slab & the person is not in india or no income).

Thank You,

Mohamed

Regards

Madhura H.

I am gone mad about this article for filling PF form.

No one cant explain like this.

you are awesomeeeeee.

Thank you very very much dude for this explanation.

Nice article.

If there are any more article or your blog, please send the link to the mail id (harikrishna2005@gmail.com)

The best way to get answers of all your questions is to file an RTI application. Its very easy and can be done online. Please read <a href="http://www.jagoinvestor.com/2012/03/rti-for-epf-withdrawal-or-transfer.html">this </a> post.

i urgently in need of my money. that old company asking to get transfer to new comp pf a/c. but i'm not interested to transfer and only want to withdraw. what i have to do next??? Thanks in advance. pls help....

Thanks,

Saba.

The rule is that if you worked for less than 6 months then you are not eligible to withdraw your pension amount but you can withdraw the PF amount (Your total EPF amount comprises of 2 parts: one is pension , other is PF. see <a href="http://www.humlog.net/finance/calculation-of-epf-amount-with-interest">EPF amount breakup</a> ). So you just submit form 19 for PF withdrawal.

i want to know what documents needs to be attached with forms.

1- can i attach bank statement in place of canceled check??

2- is ID proof required to be attached

3-if required, can Rashan card be given for ID proof and address proof?

4- if my employers signs. can i submitt the form in my state PF office. employer is in other state.

need very urgent reply

If any one wants to submit PF Withdrawal or Transfer form without personal visit and doing hectic process we help with nominal processing fee....

Only those who located in Bangalore and Coimbatore..

Please contact :

Arun Kumar

Direct Line:04224037831

Please suggest What should I do further.

To make sure that EPFO verifies your account number with the cancelled cheque, I suggest you try contacting your regional PF office. The contact numbers are given in <a href="http://www.epfindia.com/epfo_directory.html"> EPFO directory</a>.

In case, you are not able to contact them, you can try intimating the matter to your employer. They should help out.

You might also find <a href="http://www.citehr.com/380335-pf-settlement-issue-provident-fund.html"> this link </a> helpful.

You can give any account number in the PF form. Nothing like you have to give the same salary account. Whichever account number you give, the PF money will be credited in the same. Hope it answers your query.

Whether the PF forms(form 19,10C) should be printed back-to-back or in single sheets. Any Mandatory requirement? kindly reply.

What is Region/SRO code in form 10C?

Thanks for all the inputs. I would like to know after how much time of resignation can we apply for PF withdrawal.

Thanks.

i want to withdraw pf, so after filling the form 19 and 10c can i send it directly to the pf office address?

and i am not sure about the pf office address?

coud you please help.

More Details : http://www.jagoinvestor.com/2012/11/withdraw-your-epf-without-employer-s...

Earlier there was a provision under EPS allowing commuting of one third of monthly pension by paying 100 times the original monthly pension. However, the amended scheme w.e.f 26 Sep’ 2008 doesn’t allow it anymore. (source: <a href="http://www.themoneyquest.com/2012/02/epf-eps-facts-you-should-know-about.html">www.themoneyquest.com</a>)

I have checked my EPF balance through epfindia.com/MembBal.html which shows EE Amount:96753 and ER Amount:59583 as a sum its around 1.56 Lac. But today evening only 25953 has been credited to my account which is very far less from what i expected.

here is my claim status

Claim ID : TBTAM130100005606

Status : Claim Form 10C for Withdrawal Benefit AGAINST Member Account No (TBTAM00487710000000753) has been approved. Payment is under process.

Claim ID : TBTAM130100005604

Status : Claim Form 19 for PF Settlement AGAINST Member Account No (TBTAM00487710000000753) has been approved. Payment is under process.

I got only one transaction to my account. Will there be one more transaction from them?

Please any one help me out regarding this...

I sent my PF forms to previous organization based in mumbai but i am working out in pune so i have sent forms though courier but forgot to attach cancel cheque so what is the other option for cancel cheque ? can we send this scan copy ? i read through many articles and got answer like its just for verification. or does it compulsory to send hard copy ? any one ?

thanks,

Darshan

(darshanthacker@gmail.com)

It helps very much.

I have resigned from the company 8 months back, want to know that i m eligible to withdraw the Pension(EPS)?

What is the procedure to withdraw PF Amount if an Employer not certify the form due to dispute with a employee. I am having the Epassbook Statement. Please Guide.

More Details : http://www.jagoinvestor.com/2012/11/withdraw-your-epf-without-employer-signature.html

Details : http://www.jagoinvestor.com/2012/11/withdraw-your-epf-without-employer-signature.html

Not sure why i got less..

i got 2 epfo sms,one for form10c and other one for form 19.as per the above posts reply for the same query the amount should be credited seperately on the same date one for employee and other one for employer...If this is true i should be getting atleast minimum of Rs7000 as employee contribution(as per 9 months) but i got even less and only one credit..

appreciate your help in adavance

I was wrong when I said that one entry on my account was for employee and other one for employer. I have rectified my reply and putting the same here -

One entry is corresponding to the employee contribution and employer contribution while the other entry was EPS amount. For details, see this post - http://www.humlog.net/finance/calculation-of-epf-amount-with-interest.

Probably you have got just the EPS part. Sometimes it takes a week for the other amount to come into your account. I will suggest waiting for a week.

pls help me how is check wiht my account amount

Can any help me i worked for Concern for 9 yrs and 8 months i have claimed my PF , and i have filled both the forms 19 and 10 c , now 10 C got rejected as per status from the website , where i have mentioned Pensions Scheme not Required ., It complusory or how to claim that pension fund, and how much money will i get from Form 19

Second option - fill up PF withdrawal form, get it notorised in the place where employer has to sign, submit to pf office with your covering letter indicating the reason why you can't get previous employers' signature.

Third option - is to lodge a complaint directly with the Regional Provident Fund Commissioner of the region where your PF account is held. However, before submitting the complaint, I would suggest that you send a Registered Letter to the VP / AVP - HR of the company that you were working with and demand for an attestation of your PF documents and inform that in case they are not willing to do so, you would lodge a complaint directly with the PF Commissioner and would take necessary legal steps as well. Usually, the companies clear up the PF documents simply with such a threat. However, if they don't, Go ahead with you complaint to the Regional Provident Fund Commissioner whose address you can find from the website http://www.epfindia.com.

Source Page: http://jobs.siliconindia.com/career-forum/How-to-withdraw-my-PF-amount-without-employers-interference--qid-834-catid-27.html

I was working with Bharti Axa LIC for approx 3 years.Then I had to quit my Job in January 2011.

till today I have not settled my PF account .Can I apply /send the PF forms directly to the PF office where my account was there ? Is my PF amount taxable ? My PF account lies with Mumbai office & I belong to Odisha.Kindly suggest me he procedure for withdrawal .

Regards,

Sonima jyoti

Regarding tax on PF amount:

Your own contribution to PF is not taxable. The company contribution for less than 5 years is taxable income. If the total service is more than 5 years in two or more companies, the total company contribution is NOT taxable. If a firm is shut down and that is the reason for change of job or withdrawal, the company contribution is not taxable even if the length of service is less than 5 years.

Source Page: http://www.citehr.com/309023-pf-amount-taxable-non-taxable-combination-two.html

I applied for pF withdraw and submitted above forms. I recieved 2 SMS, 1 for from 19 and other for 10C. They mention different claim id for each. So shall they credit money differently for form 19 and form 10C. I recieved on credit sms from PF which mentions very less amount. Can you please let me know about this.

richa

Thank you for you post

How it was credited? it was directly credited to my account or through the check...pls let me know the details once

My PF money was credited directly in my bank account electronically.

Can u please tell me if there is any deduction of amount at the time of PF withdrawl.

as per my calculations (Employee + Employer's Contribution) my PF amount was 107000, but i have received 101000 in my account on PF withdrawl.

Please reply.

I have one query regarding PF withdrawal tax deduction.

I left my previous company after completing 3 yrs and now want to withdraw my PF money.So any idea about tax deduction.How much % they will deduct and is it flat or slab with my current salary.

I had search on INTERNET but find many ambiguous answers

If u have any information kindly share.

Thanks

Rohit

I was empleeyed at M/s AAK Associates Chennai.

I want to know about my Withdrawl (As I am already Supmitted)

Cliam ID:121000039041 Form10c & 121000039037 PF settlement ID

and pls confirm Status and how i will get money PF office

Thanks & Regards,

Laxman P G (9791080155)

Claim ID : TNMAS121000039041

Status : Claim Form 10C for Withdrawal Benefit AGAINST Member Account No (TNMAS00501280000000032) has been rejected. Rejection letter is under dispatch/ dispatched to address in your claim

Claim ID : TNMAS121000039037

Status : Claim Form 19 for PF Settlement AGAINST Member Account No (TNMAS00501280000000032) has been rejected. Rejection letter is under dispatch/ dispatched to address in your claim form.

Claim ID : TNMAS121100018933

Status : Claim Form 19 for PF Settlement AGAINST Member Account No (TNMAS00501280000000032) has been approved. Payment is under process.

Claim ID : TNMAS121100018937

Status : CLAIM FORM 10C FOR WITHDRAWAL BENEFIT/SCHEME CERTIFICATE FOR MEMBER ACCOUNT NO TNMAS00501280000000032 HAS BEEN RECEIVED ON 15.11.2012 IS UNDER PROCESS.

The time taken would be around 1-2 months from the date of receipt of forms by EPFO.

You have to fill separate forms for separate PF accounts. In those different forms you can mention the same bank account and your pf money will be refunded in the same. Hope it helps.

can u pls tell that how many time it will take to get the money in my account .

This page is so much useful! It is a one stop solution for all PF withdrawal form queries. God knows how much time I would have spent trying to find out what to fill in each place if I didn't see this page.

I hope all those who are lost in the details of pf form filling will find this page sooner.

Thanks a lot

Panduranga